However the spread fixed at the time of sanction of loans to all borrowers should remain fixed all through the term of the loan. Benchmark prime lending rate by rbi in 2003.

Vajiram Ravi Rbi Cuts Benchmark Interest Rate Again Facebook

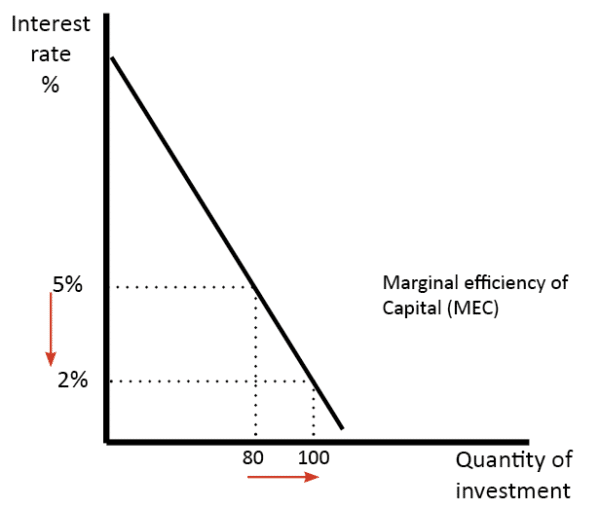

At present interest rates on loans are linked to a banks marginal cost of fund based interest rate known as the marginal cost of lending rate mclr.

Benchmark interest rate upsc. Prime lending rateplr a prime rate or prime lending rate is an interest rate average rate of interest charged on loans used by banks usually the rate at which banks lend to favored customers ie. Marginal cost of lending rate. What does the rbi move mean for you banks will have to link interests to external benchmarks instead of internal ones which is the current norm.

It is a benchmark lending rate for floating rate loans. Linking interest rate to external benchmark. External benchmark based lending of rbi or floating rate loan in hindi for upsc ias exam.

Plr was replaced by bplr. It came into effect in april 2016. This rate is based on four componentsthe marginal cost of funds negative carry on account of cash reserve ratio operating costs and tenor premium.

A minimal interest rate set and published by commercial banks for accumulating interest on different credit types. The marginal cost of funds based lending rate mclr is the minimum interest rate that a bank can lend at. What is external benchmarking of loans.

12 upsc prelims 2020 economy external benchmark interest rate marginal cost of fund interest rate crux of indian economy. Mclr is a tenorlinked internal benchmark which means the rate is determined internally by the bank depending on the period left for the repayment of a loan. Those customers with good credit.

This is the minimum interest rate at which commercial banks can lend. Existing loans and credit limits linked to the mclr base rate or benchmark prime lending rate would continue till repayment or renewal. The marginal cost of fund based lending rate mclr is currently the benchmark for all loan rates.

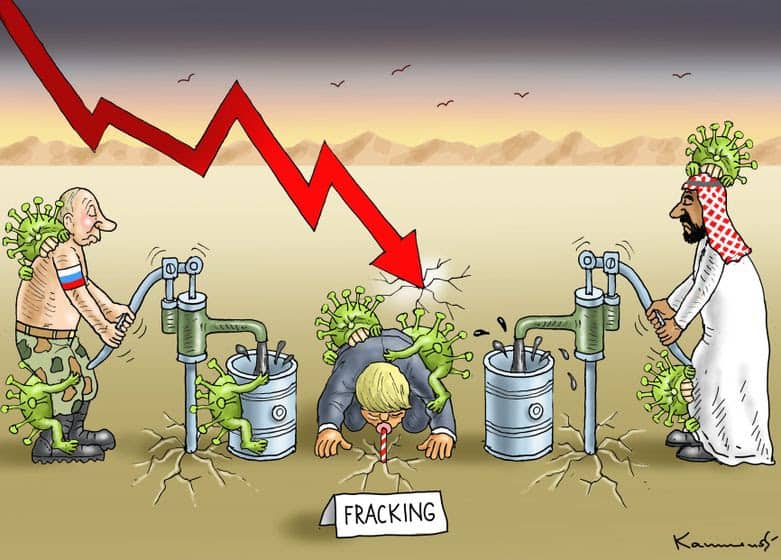

Most commercial banks in india are likely to select rbis repo rate as the external benchmark to decide their lending rates from april 1. Interest rate spread also the decision on the interest rate spread over the external benchmark should be left to the commercial judgment of banks. The repo rate is the key policy rate of the reserve bank of india rbi.

Https Empowerias Com Blog Prelims Special Facts Nbfc Loan Pricing Under Rbi Lens Gs 3 Empower Ias

Transmission Of Monetary Policy Rates By Jatin Verma

What Is A Negative Interest Rate Free Pdf Download

Investment And The Rate Of Interest Economics Help

Upsc Ias 2019 Economy External Benchmarking Of Interest Rates

Know All About Bank Mclr Lending Rate Times Of India

Understanding Bond Prices And Yields

Insights Into Editorial Is The Indian Economy Staring At

Explained Why Interest Rates Aren T Falling Onestop Upsc

Prelims Current Affairs Upsc Cse Sept Week 1 The Prayas India

Monetary Policy Decisions Rbi Reduces In Repo Rate Upsc

Upsc Ias Preparation Only Most Important Current Affairs For

Negative Interest Rates Impact On European Savings And Retail Banks

Why The Repo Is Not A Suitable External Benchmark The Hindu

Upsc Exam Current Affairs And News Analysis 08 02 2020

Upsc Current Affairs Monthly Hindu Review Top 50 Current

How Interest Rate Swaps Work Commerce Bank

Negative Interest Rates Impact On European Savings And Retail Banks

Negative Interest Rates Impact On European Savings And Retail Banks

London Interbank Offered Rate Libor

Linking Loan Rate With Repo Rate Good And Bad For Borrowers

External Benchmark Rates Explained

Ramanasri IAS Institute is best IAS Academy in Delhi which has likewise numerous focuses all over India which are gone through satellite for example live classes from Delhi. All offices are accessible at our focuses. You need to be become an IAS in future at that point join Ramanasri IAS Institute in New Delhi. We give best investigation materials, instructive conditions and experienced instructor for understudies. The Ramanasri IAS Institute, the main IAS preparing focuses in India gives a lot of significance to intuitive and scientific ability improvement, for example, familiar correspondence, legitimate argumentation, scholarly dynamic limit, and mental. upsc statistics optional

ReplyDeleteYour blog is very informative. Nowadays current affairs have become a very important section of the competitive exam. Most of the questions are asked from this section. Read Best current affairs for UPSC and IAS daily current affairs for the preparation for the exam.

ReplyDelete