An efficient way is by monitoring the dynamics of a limit order book to identify the information edge. This paper describes the first publicly available benchmark dataset of high frequency limit order markets for mid price prediction.

We extracted normalized data representations of time.

Benchmark dataset for mid price forecasting of limit order book data with machine learning methods. Benchmark dataset for midprice forecasting of limit order book data with machine learning methods article pdf available in journal of forecasting august 2018 with 825 reads. An efficient way is by monitoring the dynamics of a limit order book to identify the information edge. An efficient way is by monitoring the dynamics of a limit order book to identify the information edge.

This paper describes the first publicly available benchmark dataset of high frequency limit order markets for mid price prediction. 0 share. Presently managing prediction of metrics in high frequency financial markets is a challenging task.

This paper describes the first publicly available benchmark dataset of highfrequency limit order markets for midprice prediction. Managing the prediction of metrics in highfrequency financial markets is a challenging task. 05092017 by adamantios ntakaris et al.

Managing the prediction of metrics in high frequency financial markets is a challenging task. Benchmark dataset for mid price forecasting of limit order book data with machine learning methods adamantios ntakaris1 martin magris 2juho kanniainen moncef gabbouj1 alexandros iosifidis3 1laboratory of signal processing tampere university of technology tampere finland 2laboratory of industrial and information management tampere university of. Benchmark dataset for mid price forecasting of limit order book data with machine learning methods adamantios ntakarisa martin magris b juho kanniainen moncef gabbouja alexandros iosi disc alaboratory of signal processing tampere university of technology korkeakoulunkatu 1 tampere finland blaboratory of industrial and information management tampere university of technology.

Benchmark dataset for mid price prediction of limit order book data. Managing the prediction of metrics in high frequency financial markets is a challenging task.

Order Flow Analysis Of Cryptocurrency Markets Springerlink

Artificial Intelligence Stanford Encyclopedia Of Philosophy

Artificial Intelligence In Education Challenges And Opportunities

Chapter 9 Statistical Learning And Predictive Analytics Modern

Http Poseidon Csd Auth Gr Papers Published Conference Pdf 2017 2017 Cbi Cnnlob Pdf

Classification Based Financial Markets Prediction Using Deep

Machine Learning For Forecasting Mid Price Movement Using Limit

Https Arxiv Org Pdf 1904 05384

Classification Based Financial Markets Prediction Using Deep

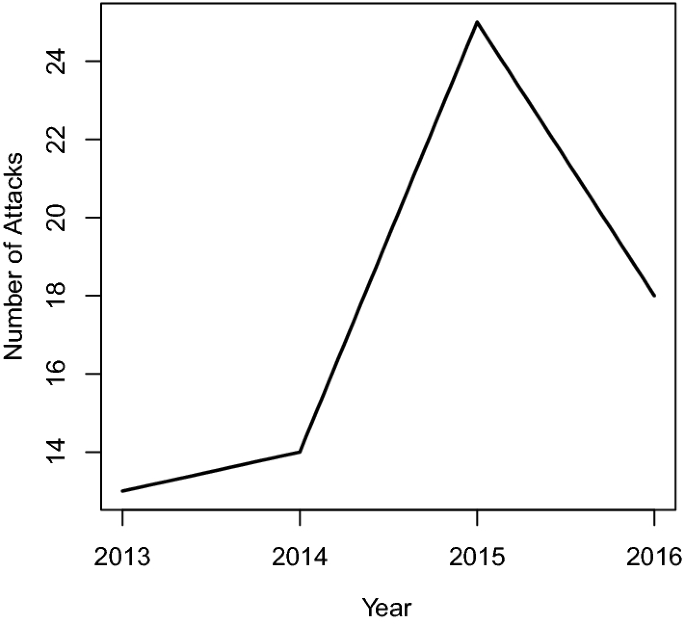

Attack Detection In Water Distribution Systems Using Machine

Https Ieeexplore Ieee Org Iel7 6287639 8600701 08743410 Pdf

Jrfm Free Full Text Trend Prediction Classification For High

Universal Features Of Price Formation In Financial Markets

Https Bigdatafinance Eu Wp Wp Content Uploads 2017 07 Machine Learning Approaches For High Frequency Financial Data Analysis Pdf

Https Www Ijitee Org Wp Content Uploads Papers V8i9 I7849078919 Pdf

Artificial Intelligence Stanford Encyclopedia Of Philosophy

Pdf Benchmark Dataset For Mid Price Forecasting Of Limit Order

The 2016 Survey Algorithm Impacts By 2026 Imagining The Internet

Https Ec Europa Eu Research Participants Documents Downloadpublic Documentids 080166e5c0d60403 Appid Ppgms

Https Www Epfl Ch Schools Cdm Wp Content Uploads 2019 02 Cont Swissquote2018 Pdf

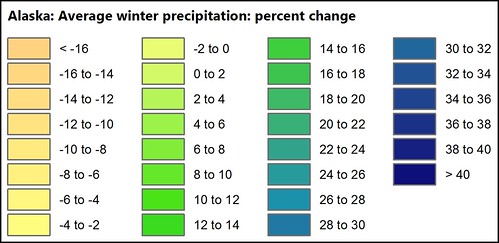

Wcdmp 85 Ninth Seminar For Homogenization And Quality Control In

No comments:

Post a Comment