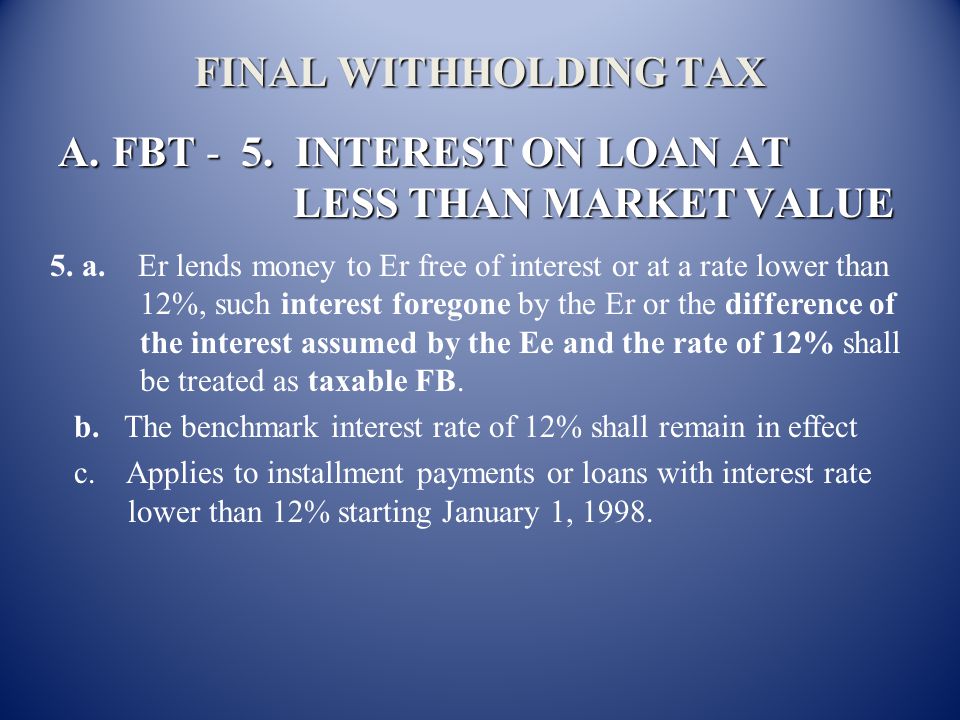

The benchmark interest rate is used to calculate the taxable value of. This rate replaces the rate of 565 per cent that had applied for the previous fbt year commencing on 1 april 2016.

Head In The Sand About Fbt It S Not As Scary As It Sounds

This rate replaces the rate of 525 that has applied for the previous fbt year commencing on 1 april 2017.

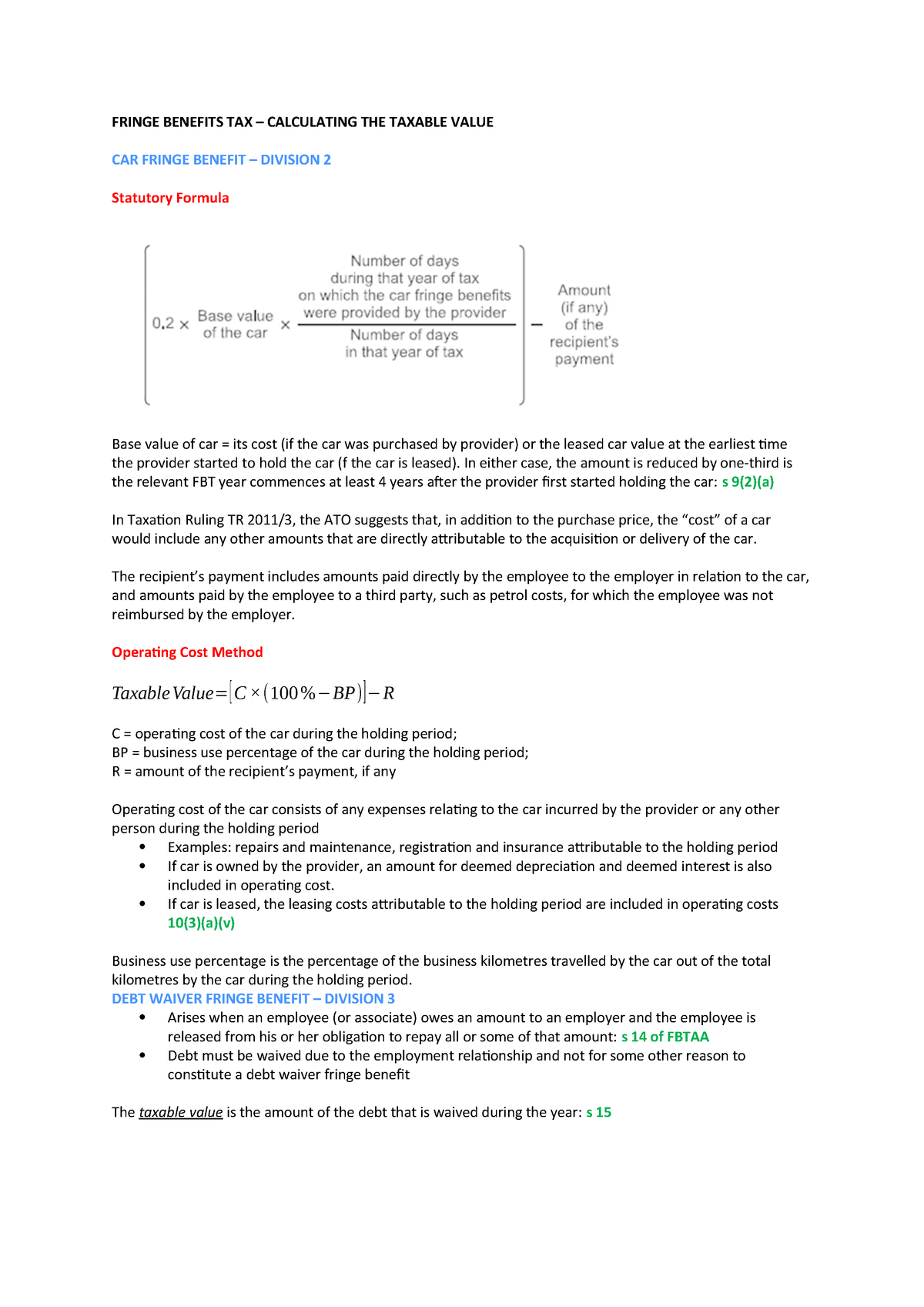

Benchmark interest rate fbt. The tax office determines the benchmark interest rate from the standard variable rate for owner occupier housing loans of the major banks published by the reserve bank of australia in the period immediately before the fbt year. The benchmark interest rate for the fringe benefits tax fbt year commencing on 1 april 2017 is 525 per cent per annum. The benchmark interest rate is used to calculate the taxable value of.

Year of income ended 30 june ato reference. And a car fringe benefit calculated using the operating cost method. 565 applied in 201617.

The division 7a benchmark interest rate for an income year is the indicator lending rates bank variable housing loans interest rate last published by the reserve bank of australia before the start of the income year for 201920 the deemed dividends. The benchmark interest rate for the 201819 fbt year is 520 pa which is used to calculate the taxable value of. Gross up rates for fbt type 1.

This rate is used where the benefit provider is entitled to a goods and services tax gst credit in respect of the provision of a benefit. This is the indicator lending rates bank variable housing loans interest rate published by the reserve bank of australia on 4 june 2019. And a car fringe benefit where an employer chooses to value the benefit using the operating cost method.

Fbt benchmark interest rates for the fbt years 2011 to date. If your fbt liability for the last year was 3000 or more you will need to pay four quarterly instalments. A fringe benefit provided by way of a loan a car fringe benefit where an employer chooses to value the benefit using the operating cost method.

The prescribed rate of interest used to calculate fringe benefit tax on low interest employment related loans is 577 down from the previous rate of 599 which applied from the quarter beginning 1 october 2015. This rate is used to calculate the taxable value of. Fbt rate for low interest loans decreases.

A loan fringe benefit. A car fringe benefit where an employer chooses to value the benefit using the operating cost method. A loan fringe benefit.

The benchmark interest rate for the fringe benefits tax fbt year commencing on 1 april 2018 is 520 per annum. Ato div 7a benchmark interest rate. A loan fringe benefit.

The benchmark interest rate for the 201718 fbt year is 525 pa.

Fbt Planning Workshop 2013 Presented By Rebecca Brabazon Dean

Fbt 2018 The Ato S Top 5 Triggers Myca Wordpress

Fringe Benefits Tax Ppt Video Online Download

Income Taxation 6th Edition By Valencia Chapter 6

Individual Group Of Features Cases Download Table

Https Nickelasia Com Assets Documents Nikl Definitive Is 2017 Pdf

Fringe Benefits Tax Ppt Video Online Download

Fbt Formula Blaw30002 Taxation Law I Unimelb Studocu

Ex 1 2 A19 21680 7ex1 Htm Ex 1 Exhibit 1 2019 Annual Report It

Welcome To The Withholding Tax System Ppt Download

Fbt Benchmark Interest Rate Fsa Partners

Improving Probability Judgment In Intelligence Analysis From

Chapt 6 Fb Tax Employee Benefits Taxes

Philippines Philippines 2007 Article Iv Consultation Staff

Fbt Qgen Sgen Icpt Large Outflows Detected At Etf Nasdaq

Easyfbt 2019 Change Log Easyfbt Blog

Labour Cost Index All Labour Costs June 2015 Quarter Pdf Free

Http Www Bsp Gov Ph Downloads Publications 2005 Ir4qtr 2005 Pdf

Ppt For Pmap Grand Men Seng Hotel June 26 2014 Presented By

Compensation Income Soriano Cesar Nickolai Jamoner Winnie Claire

Five Things You Need To Get Right This Fbt Season Thomson

No comments:

Post a Comment