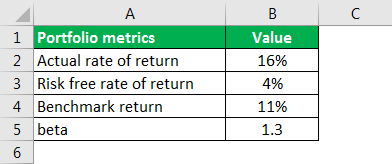

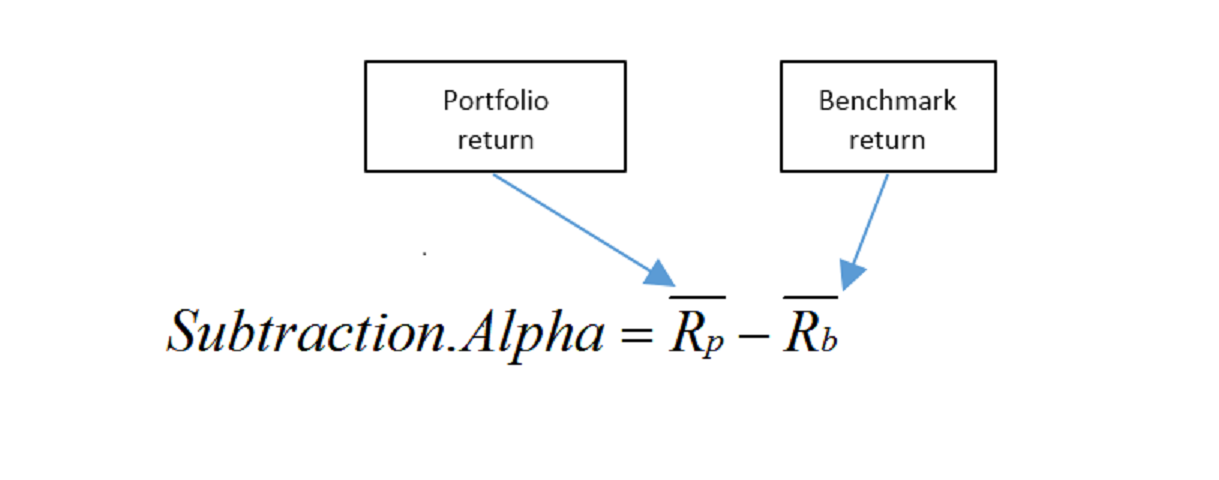

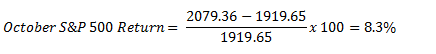

To arrive at your relative return subtract the percentage gain or loss of the benchmark which you set out to beat. The required return is a minimum return or profit what an investor expects from doing business or buying stocks with respect to the risks associated with it for running a business or holding the stocks.

Http Www Riordan Consulting Com Pdf Attributionhandout Pdf

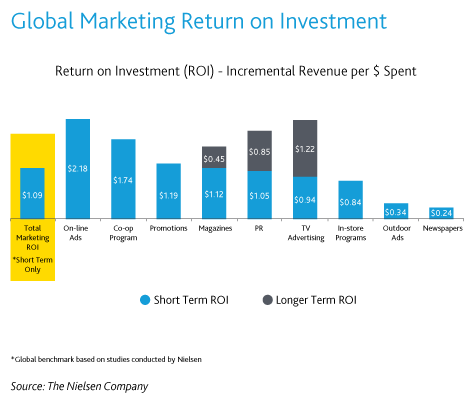

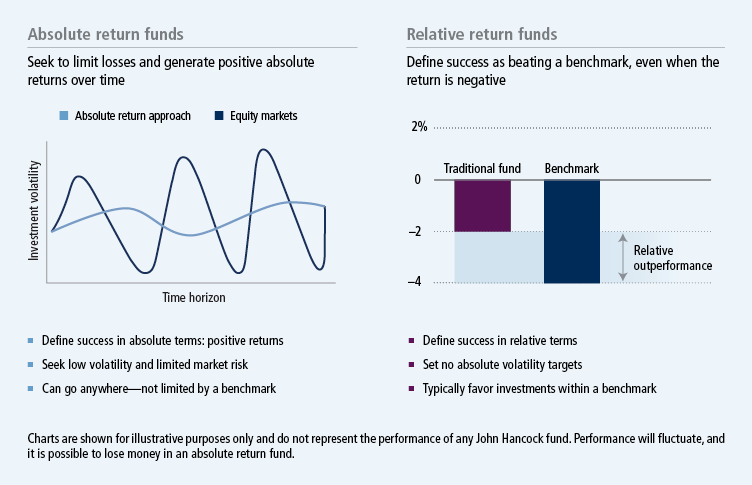

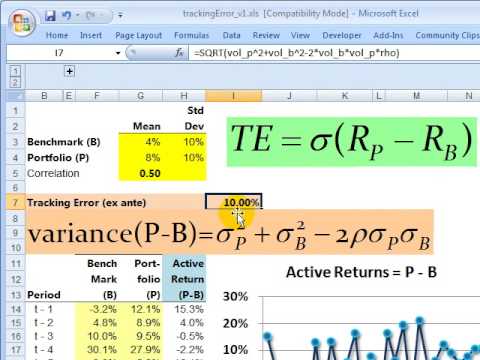

Information ratio is used to measure the performance skills and ability of portfolio managers to generate a return over the benchmark.

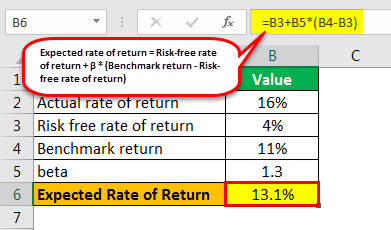

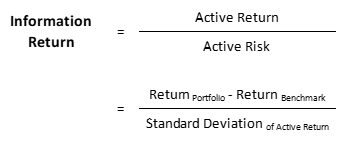

Benchmark return formula. Performance attribution profit attribution or investment performance attribution is a set of techniques that performance analysts use to explain why a portfolios performance differed from the benchmarkthis difference between the portfolio return and the benchmark return is known as the active returnthe active return is the component of a portfolios performance that arises from the fact. Because bob earned an annualized 11 return and alice earned a 125 return. In other word the information ratio is risk adjusted return relative to benchmark return.

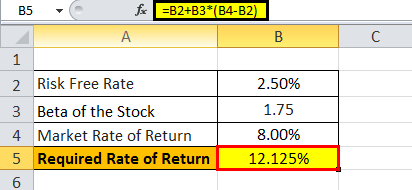

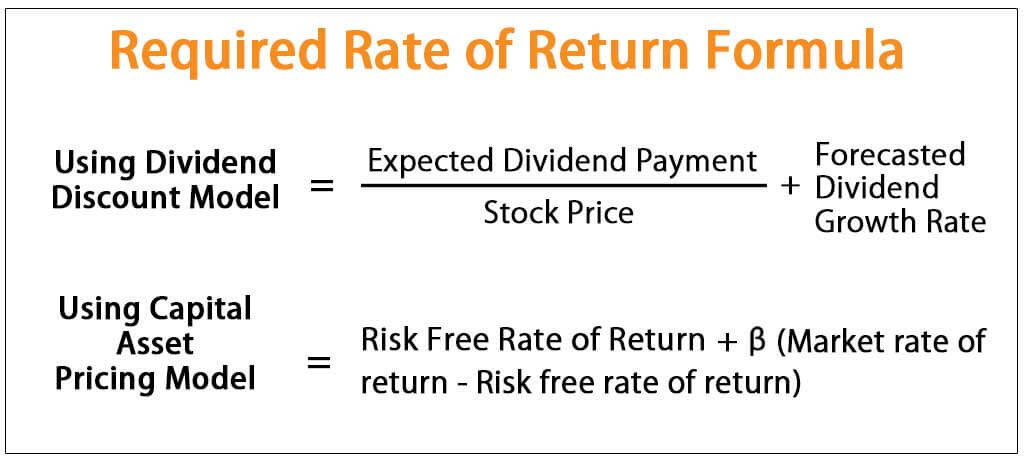

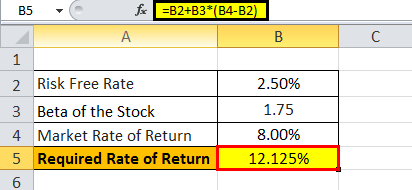

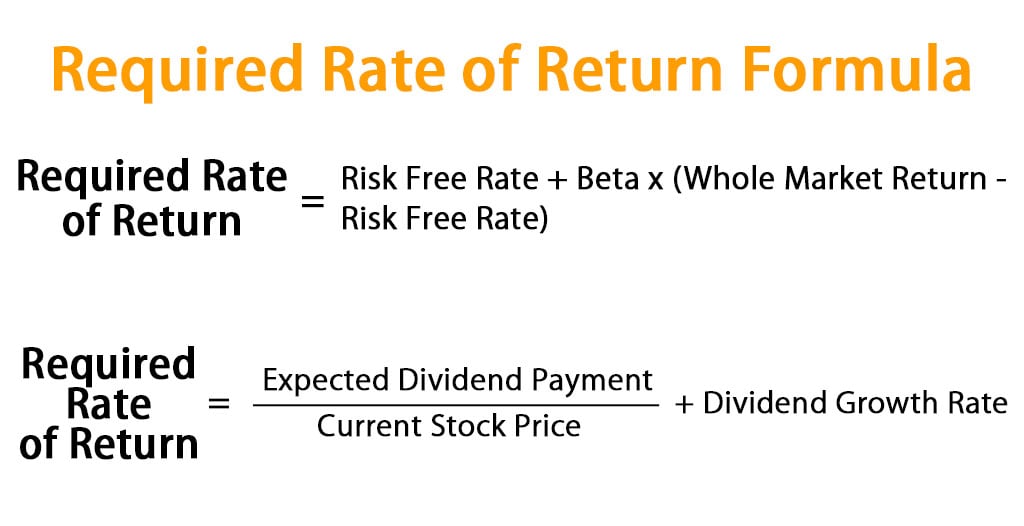

Your relative return equals 8 6 percent for a 2 percent return. Examples of required rate of return formula with excel template required rate of return formula calculator. The total return index is a very useful benchmark when we want to find out the actual return generated for constituents of a stock or a mutual fund.

Benchmark here is usually an index which is a representation of the market. A useful investing exercise is to always be expanding your awareness of what constitutes a good benchmark. Required rate of return formula.

It is a very useful measure because it actually states what the investor is taking back or getting in return out of the investment made. Based on this the market risk premium can be calculated by deducting the risk free return from the market return. Next determine the market rate of return which is the annual return of an appropriate benchmark index such as the sp 500 index.

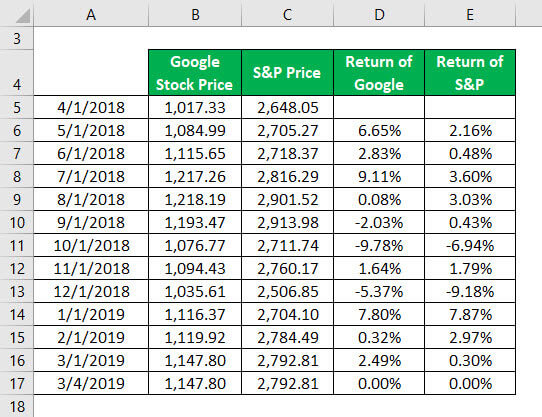

Year to date as of november 3 it had a return of 7606. How to calculate return on indices in a stock market knowing how an index is performing can give you an idea of how the market is doing and how your portfolio is doing relative to the index. Market risk premium market rate of return risk free rate of return step 3.

Your absolute return equals 540 500500100 or 8 percent. Say your benchmark is the sp500 index and the sp advanced by 6 percent during the same period. Libor is one of the most widely used benchmarks for short term interest rates and the fed controls another common interest benchmark known as the fed funds rate.

A benchmark is a standard against which the performance of a security mutual fund or investment manager can be measured. A good benchmark should appropriately reflect the portfolios investment style and strategy as well as the investors return expectations. Next compute the beta of the stock based on its stock price.

Alpha Formula How To Calculate Alpha Of Portfolio Examples

Determination Of Risk Adjusted Measures Sap Documentation

Required Rate Of Return Formula Step By Step Calculation

How To Choose A Return On Investment Measure Toptal

Required Rate Of Return Formula Step By Step Calculation

Alpha Formula How To Calculate Alpha Of Portfolio Examples

Information Ratio Formula How To Calculate Information Ratio

Understanding Differential Return Part 1 Vs Subtraction Alpha

Cfa Level 3 Performance Evaluation Frugal Fortunes

Private Equity Policy Benchmarking And Performance Attribution

Quiz Worksheet Excess Returns Study Com

Required Rate Of Return Formula Calculator Excel Template

Want The Best Marketing Return On Investment

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps

Level 2 Portfolio Question About Expected Active Return Cfa

Determination Of Risk Adjusted Measures Sap Documentation

How To Calculate The Overall Cagr Of All My Investments In Mutual

Information Ratio Formula Calculator Excel Template

Alpha Learn How To Calculate And Use Alpha In Investing

How To Calculate Return On Indices In A Stock Market The Motley Fool

What Is Absolute Return Investing

Measuring Active Return With The Information Ratio Cfa Level 2

No comments:

Post a Comment